Taxes are levied on the sale of goods and services. It is imposed at each stage of the production process, from the raw materials to the final product. Business collect taxes from their customers and pay it to the government. In this process, they need some documentation, and a Tax invoice template is just made for this purpose.

What is a Tax Invoice Template?

Table of Contents

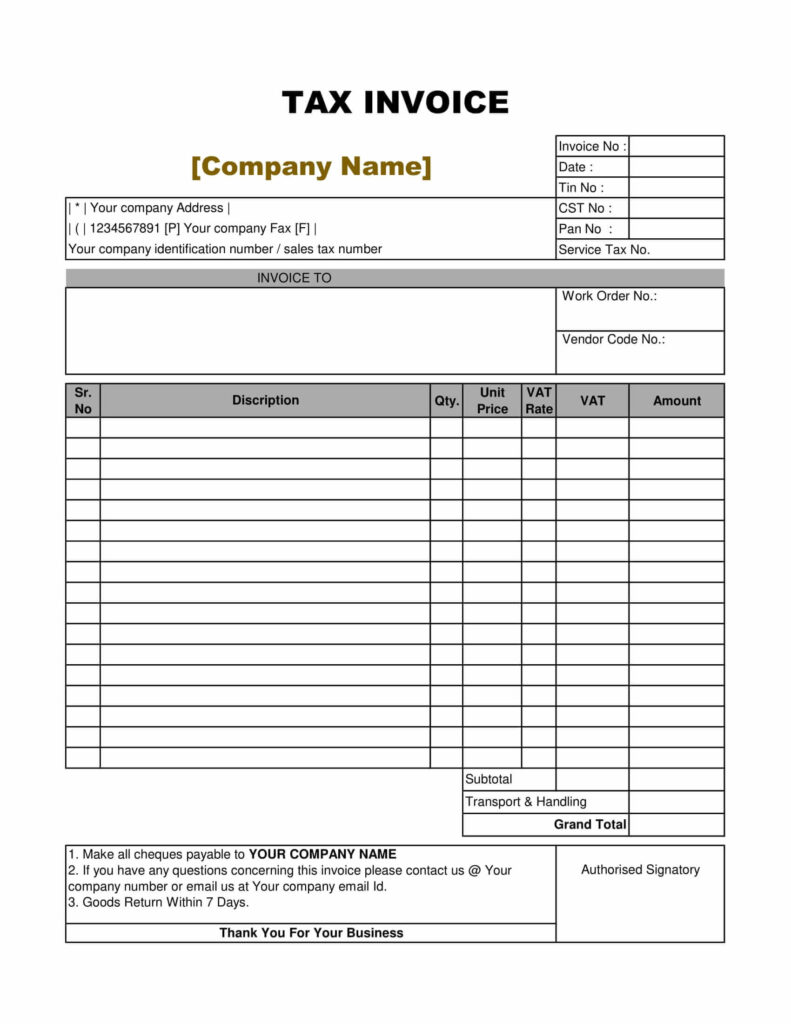

A Tax Invoice is a document businesses issue to customers to bill for goods or services sold. This document contains key information about the transaction, including the Tax amount.

United States has mainly 7 types of taxes

- Income taxes

- Sales taxes

- Excise taxes

- Payroll taxes

- Property taxes

- Estate taxes

- Gift taxes

If you are registered for any of the tax category in your country, you must issue a tax invoice whenever you supply goods or services to another business. This document provides key information about the transaction, including the tax amount.

Creating a professional Tax invoice template can be time-consuming and complicated. However, using our editable templates can make your work easy than ever.

Reasons to Use Tax Invoice Template?

There are many benefits of using a Tax invoice template.

- The key purpose of this document is to record the sale of goods or services and the corresponding VAT charged. This information is then used to calculate the amount of VAT you owe to the government.

- Another benefit of using a Tax invoice template is that it can help improve your customer service. By providing your customers with a detailed document, you can reduce the chances of them calling to ask questions about the charges.

Details to Fill in a Tax Invoice Template?

A VAT invoice must include the following information:

- The name, address, and Tax registration number of the supplier

- The date of supply

- A description of the goods or services supplied

- The quantity of goods or services supplied

- The unit price of the goods or services (excluding Tax)

- The total amount charged (excluding Tax)

- The rate of Tax charged

- The total amount of Tax charged

This information helps the customer understand the charges and provides vital information for the supplier regarding calculating their Tax liability.

Conclusion

Lastly, we can say that a Tax invoice template is an essential document for businesses. It helps keep track of sales and provides the customer information about the transaction. Using a professional template can save you time and money in the long run.