If you’re like most businesses, you have a strict policy when it comes to invoices. You expect them to be paid on time, every time. But sometimes, things happen. An invoice gets lost in the shuffle, or a customer has a temporary cash flow issue.

When this happens, it’s important to take action quickly. The sooner you can get your invoice paid, the better. But how do you do that without appearing too demanding or pushy? Let’s dive into the post to know all.

What is a Thirty (30) Days Past Due Invoice Template?

Table of Contents

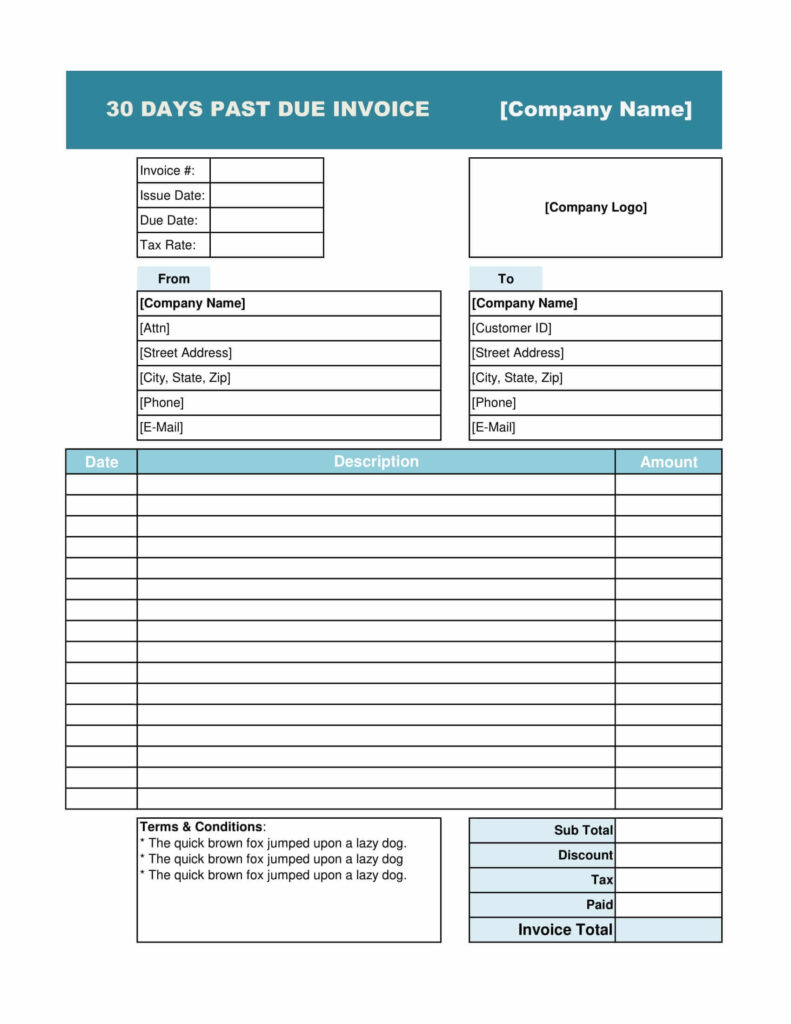

A Thirty (30) Days Past Due Invoice Template is simply a document that businesses can use to bill customers who have failed to make payment within the agreed-upon time frame.

This invoice includes all the necessary information such as the amount due, the date of service, and the customer’s contact information.

Reasons to Use a Thirty (30) Days Past Due Invoice Template?

These are a few key reasons why you might want to use a Thirty (30) Days Past Due Invoice Template.

- First, it serves as a formal reminder that payment is overdue. This can help get the attention of customers who may have forgotten about the invoice or were hoping to avoid it.

- Second, a Thirty (30) Days Past Due Invoice Template can help you track which invoices are past due. This is important information to have when you’re trying to manage your cash flow and ensure that you’re getting paid promptly.

- Finally, a Thirty (30) Days Past Due Invoice Template can help you avoid late fees. If you have a late fee policy in place, this template can help you enforce it. Including the late fee on the invoice will ensure that customers are aware of the penalties for not paying on time.

Details to Fill in a Thirty (30) Days Past Due Invoice Template

There are a few key things that you’ll want to include in your Thirty (30) Days Past Due Invoice Template.

- First, make sure to include the original invoice date and number. This will help customers know which invoice is past due.

- Next, include the amount of the invoice and the date that payment is due. It’s also a good idea to include late fees, if you have them. This way, customers will know what they’re responsible for if they don’t make timely payments.

- Finally, make sure to include your contact information. This way, customers can reach out to you with any questions or concerns about the invoice.

Tips for Using a Thirty (30) Days Past Due Invoice Template

A few things to remember when using a Thirty (30) Days Past Due Invoice Template.

- First, be sure to proofread the template before sending it out. It will help ensure that all of the information is accurate and up-to-date.

- Next, consider personalizing the template for each customer. This can be as simple as adding a note expressing your hope that they’re doing well or offering a discount for timely payment.

- Finally, don’t be afraid to follow up. If you don’t hear back from a customer after sending a Thirty (30) Days Past Due Invoice Template, give them a call or email. Sometimes, all it takes is a reminder to get the payment you’re owed.

By following these tips, you can use a Thirty (30) Days Past Due Invoice Template to effectively remind customers of their outstanding balance and help ensure that you’re getting paid promptly.

Conclusion

Sending a Thirty (30) Days Past Due Invoice Template is a great way to remind customers of their outstanding balance and help ensure that you’re getting paid promptly. Be sure to include all relevant information, proofread the template before sending it out, and follow up with customers if you don’t hear back.